I was having trouble getting a hold of other mortgage brokers after 5 pm. Furthermore, The thing that separates Mark Fulop from other mortgage brokers was the fact that he was always available. In fact I tortured him by calling him frequently with a million questions. The thing I like about him is that he never complained when I bombarded him with questions even late at night or early in the morning.

There are many mortgage brokers but only one that is patient enough to deal with demanding clients like myself.

Mike Chow

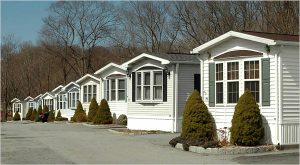

1100 Salem Valley Rd, Winston–Salem, NC 27103-4641 (Above Photo)

Refinance Cash Out

112 Unit Apartment Building

5.25% fixed for 10 years 30 am (Closed in August 2015)

We specialize in Multi Family Funding. (1-4 unit 5 unit and up) ($350,000 to $300,000,000)

Are you currently looking for funding for an apartment building or mixed use.

Purchase – Refinance – Cash Out) FULL DOC LOAN

Offering better rates than the local banks for full doc loans.

Normally loans under $1,000,000

3.75-5.35% fixed for 5,7 years 25-30 am 75ltv 25% down

Loans ranging $1,000,000 to 3,000,000

4% – 5% fixed for 10 years 25-30 am 80ltv 20% down

Loans Ranging $3,000,000 and up

%3.5-4.5% fixed for 10 years or 35 years fixed. 80-90ltv 10-20%

Yes its possible to get funding with 10”;,% down with an apartment building loan over 3 million but it takes 6 months so most people choose to pay 20% and get funded in 40-50 days.

Offering a very large variety of lenders for apartment funding for full doc, limited doc, and no tax returns loans. All require a minimum fico of 650 better. Purchase under personal name or under llc or corp.

Common questions?

Can i borrower the down payment? No

Can I have the seller hold back the down payment or % of down payment? No

The borrower must have the down payment in the bank for at least 30-60 days to use down payment,

In some cases I can allow a 5% seller second.

Buyer must produce down payment + 6 months cash reserves to show you the borrower can pay mortgage+ third party closing costs. Closing 40-45 days!

Can I purchase with partners or personal name? Purchase or refinance under LLC, Corp or Personal name.

Can I get a non recourse loan? Normally non recourse is for bigger loans over 2-3 million. Case by case!

Needed Documents! Purchase contract or L.O.I ( Need P.F.S for a full doc loan, copy of credit report, income and expense/rent roll/leases

Full Doc Loan for Apartment Buildings. (Small Balance Loans)

Products Highlights:

- Highly competitive rates with fixed lender closing costs

- flexible repayment options

- Non recourse

- Streamlined process

- Loans up to 80ltv & I/o options available

- early rate lock Option

At-A -Glance

Small Balance Loan Program and credit features.

- Markets Nationwide

- Loan Amount $1 Million to $ 5 million

- Loan Purpose Acquisition or refinance

- Max LTV Up to 80% depending on purpose and market tier

- Debt service Coverage 1.25x min DSCR in standard 1.20x top market

- Amortization Up to 30 years (Interest only also available)

- Term Five,seven,10 year fixed/20 year hybrid ARM’s available

- Prepayment Provisions step down, yield maintenance and defeasance prepayment options

- Recourse non recourse with standard carve out provisions required

- Eligible Properties Conventional multifamily housing with five residential units or more, including conventional housing with tax abatement’s, Section 8 vouchers and student housing under 50% concentration

- Occupancy requirement Minimum 90% average physical occupancy required over trailing three-month underwriting period

- Escrows/Impounds Replacement reserves waived, insurance waived, property taxes required,unless LTV is 65% or less

- Minimum Fico Score 650

- Net Worth & Liquidity Net worth: Equal to the loan amount Liquidity: Equal to nine months of principal and interest

- Rate – Lock deposit 1% for 60 and 120 days

Please email your scenario? mark@commercialmortgageunlimited.com

Are you looking for money for a fix and flip loan?

- Whether you are wholesaling, flipping, rehabbing or buying to hold, we offer solutions to fit your criteria

- Equity based: we fund based on the deal

Rate: 11.5-13.5%

Term: 9-12 months

After Repair Value 50-55%

Points 3-5 points

Here is what we need:

1) Photo ID

2) Social Security Card

3) Quick Score Property Report (CDNA Report) – use the orange link below

4) Appraisal – we will order this when you are ready

5) Contractors bid for rehab needed – Only for Fix and Flips

6) Most recent three months’ worth of bank statements

7) Federal EIN letter from IRS

8) Articles of Incorporation for your LLC

9) Purchase and sale agreement

10) Preliminary title report – I just need contact information for the company you’d like to use

11) Hazard insurance binder – I just need contact information for the company you’d like to use

NO TAX RETURN NEEDED!

Best Variety of No Doc Lender Programs.

Popular No tax returns and No Fico Minimum

Are you interested in purchasing or refinancing a residential or commercial investment property but your accountant does not have this years (2015) tax returns prepared yet?Therefore if you have no tax returns or filed for a small amount a stated or limited doc is the best option for you. Eligible deals must be 1st position mortgages on a wide variety of commercial real estate with loans between $30,000 and $1MM. General terms begin with interest rates starting at 7.50% for a fully amortizing 30 year fixed commercial mortgage. Some program highlights include:

NOTE: If the property is in NJ you have to have a minimum of 5 units or 5 units plus commercial unit.

First example of a no doc loan

- $30,000 to $1,000,000

- No FICO Score Minimum

- Rates as low as 7.25%

- 30 Year Fixed

- No Upfront Lender Fees (Appraisals are paid COD after commitment)

- YSP Available

- 2 to 3 Week Closing

Properties that are Eligible include:

- Self Storage

- Multi-Family

- Mixed-Use

- Strip Malls/Shopping Malls

- Retail Spaces

- Office Spaces

- Warehouses

- Day Care Centers

- Light Industrial

- Hospitality

- Marinas

- Auto Body Shops

- Auto Repair Shops

- Car Wash

- Mobile Home Parks

- Churches

Property Types that are Ineligible!

- Gas Stations

- ALF’s

- Land

- Construction

Needed Documents! Purchase contract or L.O.I (Contingent on financing), income and expense/rent roll, leases, 10-03 res loan application, credit report) leases eventually

( 2# ) Second example of a popular No Doc loan program.

(No Tax returns, 650 minimum fico)

- Rates as low as 6.74%

- Funding from $75K to $5MM

- LTVs up to 75%

- No pay stubs or tax statements required

- 650+ mid FICO qualifies

- No balloons- 30 year amortized term with a 3 or 8 year fixed period

- Investor 1-4,

- Multi-family,

- Mixed-use

- Office,

- Retail,

- Warehouse,

- Automotive Service and more

Investment Properties 1- Unit

These investment properties include single family homes, condos, town homes and 2-4 unit buildings. As long as the property is non-owner occupied, and is used for investment purposes, Velocity can provide a loan for your borrower. Maximum loan amount is $750k on SFRs and $2 million on 2-4 unit buildings with up to 70% LTV. Loan sizes over $2 million, are considered on a case by case basis. Impounds required. Loan is assumable at lender’s discretion. Program unavailable in AK, IL, MI, MN, NH, ND, SD, and VT

Multi-family (5+ units) and mixed-use buildings. Maximum loan amount is $5 million with LTV up to 75%. Impounds required. Loan is assumable at lender’s discretion. Program unavailable in IL, MI, ND, SD, TN, and VT.

Office buildings, general retail, warehouse, self- storage and automotive services. Maximum loan amount is $5 million with an LTV of 70%. Program unavailable in IL, MI, ND, SD, TN, and VT.

We offer custom tailored loan programs according to the borrowers financial profile and the current or projected cash flow.

Needed Documents! Purchase contract or L.O.I (Contingent on financing), income and expense/rent roll, leases, 10-03 res loan application.

……………………………………………….

# 3 Example of no doc loan (No Tax returns, 620 minimum fico)

Today many traditional banks will not underwrite small balance loans or loans to support building purchase, renovations, debt consolidation or some other commercial mortgage application. Many self-employed building owners find it difficult today to find funding. Here we have another great example of a limited doc loan program.

- Loans range from $25,000 to $1 million (minimum property value of $75,000)

- Credit rating 620 or better

- Property types financed include apartment buildings, mixed use, retail buildings, office buildings, warehouses, auto repair shops, day care businesses, hotels, motels, office buildings

We lend in 42 states by funding and servicing commercial mortgages for their customers. We do not lend in Alabama, Alaska, Hawaii, Michigan, Nevada, North Dakota, Vermont and West Virginia.

Eligible Properties for owner Occupied Businesses

|

PROPERTY TYPES

|

MAX LTV & DSCR OWNER OCCUPIED/NON-OWNER OCCUPIED |

|

Single Family Residence (additional collateral only)

|

70 1.00 1.20 If 100% investment property

|

|

2-4 unit property

|

70 1.25 1.35 If 100% investment property

|

|

5+ unit property

|

70 1.25 1.35 If 100% investment property

|

|

Motel/Hotel

|

65 1.30 1.75 If 100% investment property

|

|

Mixed Use (commerical & residential)

|

70 1.25 1.35 If 100% investment property

|

|

Professional Office Space

|

70 1.25 1.35 If 100% investment property

|

|

Retail Store (Free/Strip Standing)

|

65 1.35 1.55 If 100% investment property

|

|

Mobile Home Park

|

65 1.35 1.55 If 100% investment property

|

|

Office/Warehouse

|

60 1.35 1.75 If 100% investment property

|

|

Church/House of Worship

|

60 1.25 O/O only

|

|

Garage/Storage/Auto

|

50 1.40 O/ O only

|

|

Small Commercial

|

65 1.35 1.55 If 100% investment property

|

|

COMMERCIAL LOANS

|

|||

|

LOAN AMOUNT

|

|

||

|

LOAN TERM

|

5 Years – 25 Years

|

||

|

RATE

|

Fixed Rate

|

|

LIMITED INCOME VERIFICATION BUSINESS LOANS

|

|||

|

LOAN AMOUNT

|

|

||

|

LOAN TERM

|

5 Years – 25 Years

|

||

|

RATE

|

Fixed Rate |

|

INCOME PRODUCING REAL ESTATE INCOME QUALIFYING BUSINESS LOAN |

|||

|

LOAN AMOUNT

|

|

||

|

LOAN TERM

|

5 Years – 25 Years

|

||

|

RATE

|

Fixed Rate |

|

INCOME PRODUCING REAL ESTATE INCOME QUALIFYING BUSINESS LOAN |

|||

|

LOAN AMOUNT

|

|

||

|

LOAN TERM

|

5 Years – 25 Years

|

||

|

RATE

|

Fixed Rate 7.5% par ARM Prime + 4%

|

Please email to inquire if you qualify. Send 10-03 and credit report to start the loan process.

#4 No Doc Loan ( No Tax returns, 650 fico )

- No Doc

- Loan amounts from $200,000 to $5,000,000

- Minimum credit score generally 650

Programs/ Term /Am/LTV/DCR MF&Mixed Use

5 Year Hybrid/ 30 /30 50-75 Rate 7.00 – 8.25

7 Year Hybrid/ 30 / 30 50-75 Rate 7.12 – 8.37

10 Year Hybrid/ 30/ 30 5-75 Rate 7.25 – 8.5

Property Types: Multifamily, 5+ Units, Mobile Home Parks, Mixed USE, Office, retail,Lt Industrial, Self Storage, 1- single family pools (5+units- Unit value 100,000 & Min $500,000 Loan Properties must be in the same are or state. Foreign nationals: Limit to 60% LTV refi/ 65% LTV purchase Target Credit Profile: No BKS,FC in last 2 years, No lates in last 12 months Occupancy: Investor and Owner Occupied Lending Areas: nationwide except- AK,ND,SD Tertiary Markets: Population (100,000 in 5 mile radius-60ltv Index 6 months Libor Min credit score 650 Margin: 4.00% Prepayment: Step down Ex 4,5,3,2,1 Cash-Out Greater than 10% of loan amount after property liens & closing costs.

…………………………………………………………………………………………………………………………………………

- Loan amounts from $200,000 to $3,000,000

- No tax returns required for Borrower or Guarantor(s) (Investor properties only. Owner occupied properties need tax returns for business only.)

3 Months Bank Statements to support liquidity and rent collection

…………………………………………………………………………………………………………………………………………

- Bridge Loan Rate 9% to 12% fixed, Interest Only 1-2 points

- Loan amounts from $500,000 to $5,000,000

- Up to 80% Loan to Cost & 70% Loan to stabilized value

- Minimum credit score generally 650

- 1 to 2 year loan term to facilitate take out

- Nationwide

- …………………………………………………………………………………………………………..

- Limited Doc Bank Loan Program

- Loan amounts from $500,000 to $5,000,000

- Minimum credit score generally 700 (cash flow analysis required)

- 1-4 Unit Property Program

- Loan amounts from $75,000 to $2,000,000

- Minimum credit score generally 650

- Includes 2, 3 and 4 unit properties and non-warrantable condos.

Example of a Full Doc Pure Commercial Loan

Looking for a pure commercial purchase or refinance with full doc.

Pure Commercial 4.45 % Fixed for 10 Years

- Fixed for 3-5-10-15

- 20-30 Year Amortization

- Investment Properties

- 70-75% LTV Cash Out OK

Non Recourse

- Office Buildings

- Retail Store

- Warehouse

- Automotive

- Manufacturing

- Strip Mall

- Hotel

- Self Storage

Need: Mortgage statement or purchase agreement, income and expense, rent roll, leases, 2-3 years tax returns from the seller, last six months year to date, picture, PFS, Credit report, 2-3 years tax returns from buyer. Please inquire and I will send you the attachments

We also have other loan products that would require 10%-20% down but would end up being recourse.

For larger Commercial Properties

This is the best funding available

Are you thinking about refinancing a hand full of residential investment properties in order to attain a portfolio loan? Perhaps you have found a group of residential investment properties that you want to purchase for a income? We have a few great portfolio loan programs.

Cross Collateralize Properties

- Minimum 5 Units and $500,000

- 3-5-7-10 Fixed 30Y Amortization

- Unlimited Cash out OK

- Put several building together in one Mortgage one Payment,

- 1-4 Unit family Homes, Condos, Town Homes, Multifamily

- 680 fico with good tax returns

……………………………………………………………….

Full Documentation Loan

Specialize in SBA turn downs

- Need 650 fico Minimum

- Need 2 years experience in the Industry

- Must Occupy at least 51% of more

- We process and underwriter your loan and guide you through each step

- 7A & 504

- Lease Hold Improvement

- Purchase 10% Down or Refinance

- 20% down Start Ups

- Purchase with a 10% seller second if you are currently managing the location for a period of at least 12 months. 650 minimum

- Purchase just the business for 10% down then sign a lease to buy agreement. 1 -2 years later purchase the building with 10% or a seller second.

Need: Mortgage statement or purchase agreement, income and expense, rent roll, leases, 2-3 years tax returns from the seller, last six months year to date, picture, PFS, Credit report, 2-3 years tax returns from buyer. Please inquire and I will send you the attachments

Multi Family and Assisted Living Cons’t , Purchase or Refinance,

Better rates than local banks.

Under 1m 25% down 4% fixed for 5,7,10 25-30am

1m to 3m 20% down 4-4.25% fixed for 10 years 30am

$3,000,000 and up

- 40 Year Fixed 3.75%

- 85% Loan to Construction Cost

- 10Year Fixed at 4.25%

- 30 Amortization

I am actively adding more and more programs. Please sign up to receive our yearly updated list of programs emailed straight to you.